The term ‘EMI’ scares everybody when it comes to owning a house. Especially in an urban location where the cost of affordable housing is sky rocketing and EMIs take up a major chunk of the monthly income. Well, there is a good news for all planning to own their first house or renovating an existing one. Pradhan Mantri Awas Yojana (PMAY) is a scheme that grants you financial support to own your house.

What is PMAY?

PMAY is an initiative launched by the Government of India in 2015. The objective of the scheme is to provide ‘Housing for all’ a reality by 2022. With PMAY, government envisions of providing affordable housing with sanitation, electricity and water supply for every family in India. PMAY offers financial support to slum dwellers, EWS (Economically Weaker Section), LIG (Lower Income Group), MIGs (Middle Income Group) to own a house. It could be in the form of full grant, partial grant or subsidised loans depending on the income slab.

What are the objectives of PMAY?

Essenitally, PMAY aims to provide financial support to people planning to own a house who can’t afford it on a whole by themselves. This scheme puts focus on women, minority, transgenders, differently abled, senior citizens and working population altogether, making it a scheme for all.

The objective of PMAY (Urban) is to benefit urban population to build affordable constructions using sustainable and eco-friendly measures. PMAY projects to cover entire urban area of the country including 4041 statutory towns with prime importance on 500 Class-I cities. PMAY allows an individual urban family to enjoy a home loan at a 3% to 4% subsidised interest rate for a tenure of 20 years.

Who can avail the benefits of PMAY Urban?

Listed below are the categories of individuals who can avail the benefits of PMAY Urban:

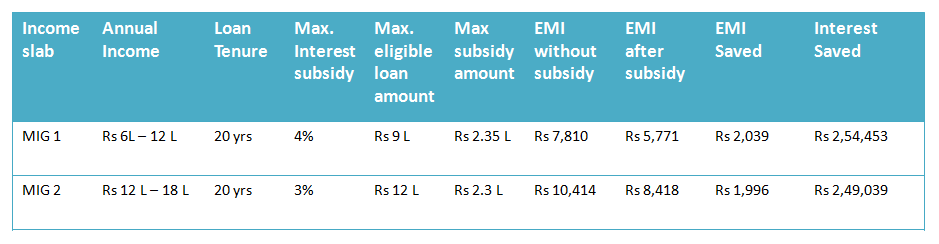

- A family whose household annual income under Rs.12 lakhs (MIG-1) can avail home loans of upto Rs. 9 lakhs with an interest rate subsidy of 4%.

- A family whose annual income is between Rs. 12 lakhs to Rs.18 lakhs (MIG-2) can avail home loans of upto Rs.12 lakhs with an interest rate subsidy of 3%.

- People planning to buy or construct a new house. (No benefits to buy an already built house)

- A family comprising of husband, wife and unmarried children with none owning a house in their name, in any other parts of the country.

- Earning children (married or unmarried) can avail the benefits of PMAY even if their parents own a home. It will then be considered as two separate households.

- A family who has not availed any other housing-related scheme issued by Indian Government.

- A family who already own a house and wants to renovate it.

To identify the deserving candidates, government uses The Socio Economic and Caste Census of 2011 (SECC 2011). The benefit of PMAY for Urban candidates, equates to a lowered EMI or faster loan repayment through CLSS.

What is CLSS or Credit Linked Subsidy Scheme?

CLSS is the PMAY benefit given against the home loan of the beneficiary. The subsidy amount is credited upfront in the loan account of the applicant. This will in turn reduce the outstanding principal amount. Thereby, bringing down the effective EMI or repay the loan faster with original EMI.

Home loans approved or under consideration since January 2017 are eligible for interest subsidy under CLSS.

What is the eligible size of building as per PMAY Urban?

The carpet area of building has to be within 120* square meter(1291 sq.ft) for MIG-1 and 150* square meter(1615 sq. ft) for MIG-2 to be eligible for PMAY.

*The Housing and Urban Ministry has announced in Jun 2018 that the Government has approved a 33% increase in carpet area of houses eligible for interest subsidy under the PMAY – Urban scheme.

The revised carpet area of the houses will be 160 square meter (1722 sq. ft) for MIG-1 group and 200 square meter (2152 sq. ft) for MIG-2 group.

The new rules will be effective from January 1, 2017, the date on which the scheme became operational.

Carpet area is the area within the walls and does not include outer walls, balcony and other common areas.

What is the procedure of availing PMAY?

First of all, check if you are eligible to apply for PMAY by looking for your name in the beneficiary list (Link: http://pmaymis.gov.in/). Alternatively, by furnishing the required documents, you can request the lending institution to notify you of the same. If eligible, you can apply for a Pradhan Mantri Awas Yojana online with the followings steps:

- Go to the official PMAY website http://pmaymis.gov.in. Choose ‘Citizen Assessment’ option from the menu

- Enter 12 digit Aadhar number. You can then go to the application page.

- Fill in personal details, current address details, income details and bank details

- Select ‘I am aware of’ option at the end of the page and click on the ‘save’ button

- Once you click ‘Save’ you will get an application number . Please save it for future reference

Once done, download and take a print copy of the duly filled application form. Submit it at the nearest CSC office and bank or financial institution with the required documents to process it along with the home loan.

The home loan providing institution will claim the subsidy benefit from Central Nodal Agency (CNA) like the National Housing Bank (NHB) or HUDCO (Housing and Urban Development Corporation). CNA will investigate for any discrepancy, including multiple requests from the same beneficiary. On approval from CNA, the subsidy amount will be given to the borrower’s bank (called as Direct Benefit Transfer or DBT). The amount will then be credited to the loan account of the beneficiary. This will reduce your outstanding principal, resulting in lesser EMI.

Is PMAY eligible for income tax exemption?

According to Income Tax Act of 1961, resident Indians are eligible for tax benefits on principal and interest components of home loan (even after PMAY subsidy). Under Section 24(b) the exemption limit for interest is Rs. 2,00,000 and under Section 80C the exemption limit for principal is Rs.1,50,000.

Pradhan Mantri Awas Yojana is a real boon if you are planning for your new house. To understand and execute PMAY supported home loan in Kerala, get in touch with Transform Property Consulting team.