Have you got the details of Tax Deducted at Source on the real estate transactions?

If not, read on……

Government is well aware of the fact that TDS is a sure way of getting revenue to the government exchequer at the earliest occasion of a transaction. That is why after section 194-1 of Income tax act, 1961 a new section, viz. 194-1A has been added which enables the government to realise TDS on high value property transactions done on or after 1st June 2013.

As per the new section, if the value of property transferred by a resident Indian is Rs.50 lacs and above, 1% TDS is to be deducted at source. TDS is applicable for land, building or flat. The buyer needs to pay the seller only the balance amount i.e. after deducting TDS from the price of land. It is to be noted that TDS has to be deducted at source regardless of the tax liability of the seller. At the same time, section 194-1A is not applicable when the transferor is Non-resident Indian.

Relevance of PAN

If the transferor has no PAN, or if it has not been given to the buyer, the rate of TDS becomes 20% instead of 1% (don’t hesitate; you have read it correctly).

Every transferor is thus enforced to take PAN before such property transaction is done and to give the same to the buyer. Even if the transferor is a senior citizen without income exceeding the non-taxable limit, PAN is mandatory unless he is prepared for 20% TDS.

Who is Responsible to Deduct TDS – When to Remit it and How?

The rule 30 of Income tax rules envisages the instructions regarding time and mode of payment of TDS to the government. The buyer is responsible to remit the TDS amount to central government within 7 days from the end of the month in which the transaction takes place. (30 days instead of 7 days if the deduction is made in the month of March.)

The amount can be remitted to the government account through any of the bank branches authorized for this purpose by e-tax payment option. In the case of real estate transactions, there is no provision for applying to the Assessing Officer as per section 197 for exempting from payment of TDS or to deduct tax at reduced rate and to get an order accordingly.

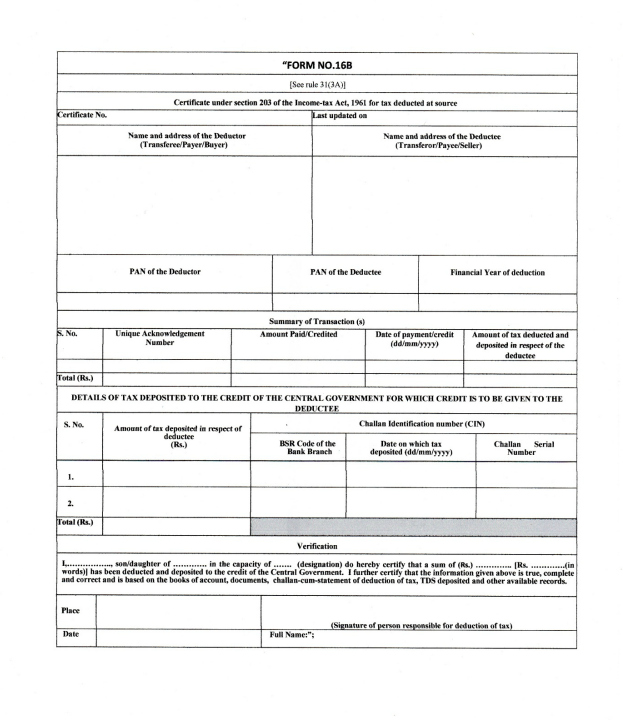

Those who are responsible to remit the tax is liable to give the transferor the certificate in form No.16B to show that TDS has been deducted and remitted to the central government, within 15 days after the last date on which the TDS is due to be remitted.

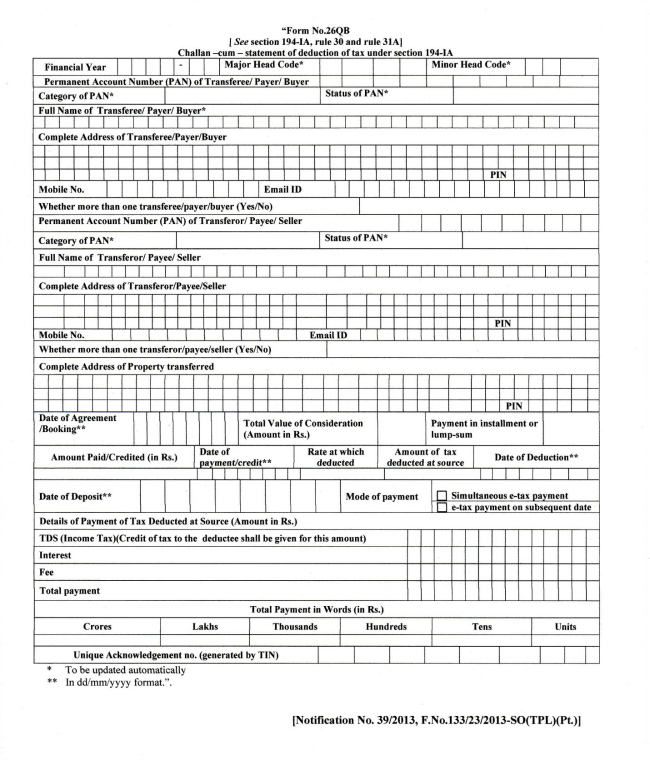

It has also been directed that payment of such TDS shall be made through a challan – cum-statement in form No.26QB. Fortunately, TAN (transaction authentication number) is not required to be obtained in respect of TDS on real estate transactions. (Forms No.16B and 24QB are shown below)

Exemption for Agricultural Land

Agricultural land has been excluded from the purview of TDS; but this exemption is not applicable for land in municipal/corporation area. Even in the case of gram panchayats, lands in the under mentioned areas will not be given the concession of agricultural land.

I.e.; the land situated within an air distance of 2kms, 6kms or 8kms from the local limits of any municipality/corporation having population below 1 lac, between 1 lac and 10 lacs or above 10 lacs respectively.